UTILITY OF WORTH (UoW) FRAMEWORK

Engineering Value Beyond Fiat and Speculation

A comprehensive framework for Quantum and Hybrid Digital Assets anchored in verifiable productivity, sovereign identity, and real-world commodities through the Vogon Distributed Quantum Ledger Database (DQLDB).

WHAT IS UoW ON VOGON?

Engineering Value Beyond Fiat and Speculation

THE CORE DIFFERENCE

Economically Sound • Provable • Productive

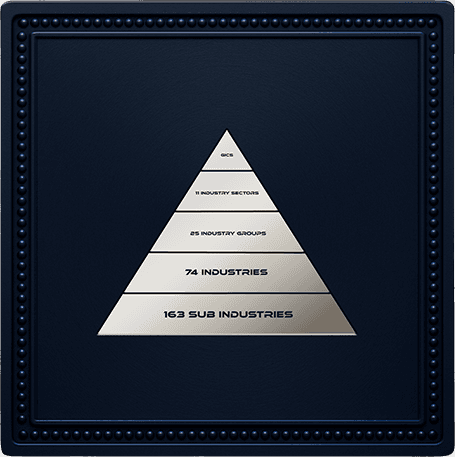

INDEXED TO MSCI GICS Sub-Industry

Market structure with commodity truth

ANALYTIC TOMOGRAPHY

Forecasting market momentum and oscillations

QUANTUM HUMAN IDENTITY (QHI) - QUANTUM DIGITAL ASSET

INTRODUCING THE QUANTUM HUMAN IDENTITY (QHI)

Sovereign anchor

Immutable identity that grants rights, responsibility, and access across the economy.

- The QHI turns identity into an investable, governable, and redeemable source of value, finally letting people and institutions share one truthful ledger of worth.

- What QHI is: A cryptographically verified, policy-governed digital identity asset that turns real human activity into auditable economic value on the Vogon DQLDB.

- What QHI does: Anchors every contribution (time, skill, compute, decisions) to traceable value units (QVUs/QDUs/Qunits) with provenance, governance, and redemption built in.

- Why QHI matters: It gives people, firms, and institutions a common, investable unit of worth, rooted in identity, not speculation.

QUANTUM ASSET PORTFOLIO AGREEMENT (QAPA)

Sovereign portfolio anchor

A canonical agreement linking a Quantum Human Identity (QHI) to their sovereign portfolio on the Vogon D²QLDB. The QAPA establishes terms for custody, governance, and valuation of Quantum Digital Assets (QDAs), ensuring assets are separated from identity while remaining cryptographically verifiable and commodity-indexed.

QUANTUM VALUE UNIT (QVU) - QUANTUM DIGITAL ASSET

INTRODUCING THE QUANTUM VALUE UNIT (QVU)

Measured worth

A unit of measurable value derived from verified digital labor and contribution, bridging identity and markets.

Codification and Reimbursement for Digital Labor

The QVU stands at the forefront of the Quantum Age, offering a robust mechanism for the codification and equitable reimbursement of digital labor. It ensures that every unit of digital work is accurately valued and compensated, aligning economic incentives with the true contributions of digital laborers.

QUANTUM SERVER ASSET (QSA) - QUANTUM DIGITAL ASSET

INTRODUCING THE QUANTUM SERVER ASSET (QSA)

Compute You Can Price: Energy You Can Monetize

Every watt of compute now has measurable, tradable worth. The Quantum Server Asset (QSA) transforms traditional server operations into auditable, policy-anchored Quantum Digital Assets (QDAs), giving data centers a financial language for efficiency, reliability, and sustainability.

The QSA is the world’s first digital instrument that turns data-center performance into measurable economic utility. Each server becomes a self-auditing energy and compute node recorded in the Vogon Distributed Quantum Ledger Database (DQLDB). Using Prometheus telemetry and the Quantum Energy Optimization Module (QEOM), the QSA quantifies operational value across seven coefficients: CPU, Memory, Storage, Bandwidth, Uptime, Thermal, and ESG. Together, these form the basis for real-time forecasting, arbitrage between renewable energy supply and compute demand, and Six-Sigma-level operational optimization.

- QCU is a physics-backed, sovereign-grade digital asset tied directly to measurable energy from infrastructure operations.

- It provides a deterministic baseline of value: immune to speculation, auditable, and anchored in reality.

- Price converges with value (P/V ≈ 1) by design, ensuring institutional confidence.

HYBRID DIGITAL ASSET (HDA) - ON THE BLOCKCHAIN WITH VOGON QDA ORACLE

Hybrid Digital Assets (HDA) , Blockchain integration with Vogon QDA Oracle

Vogon DQLDB hosts the canonical Quantum Digital Asset (QDA) record and acts as the immutable oracle of truth. Public blockchains provide secondary-market liquidity via Hybrid Digital Assets (HDAs) that mirror the QDA state under strict, oracle-enforced rules.

INSTRUMENTS OF UoW

Quantum, Crypto and Hybrid Digital Assets

Each asset class is engineered for durability, yield, and measurable impact, bridging sovereign identity to productive capital.

QUANTUM ASSET PORTFOLIO AGREEMENT (QAPA)

Governed Identity Portfolio

Trustless agreement managing issuance, validation, and portfolio integrity across coalitions and assets.

QUANTUM DIGITAL ASSET (QDA)

Canonical Quantum Value and Oracle

A verifiable, immutable digital construct that encodes real-world value, energy, labor, or data into a transparent, quantum-secure ledger. Each QDA serves as both a tradable asset within the Vogon DQLDB and a canonical oracle linking physical utility to hybrid digital and cryptocurrency markets.

BLOCKCHAIN CRYPTO ASSET (BCA)

Immutable Ledger & Database Integration

A blockchain-based asset that leverages the Vogon D²QLDB as its immutable and transparent database of record. The BCA preserves auditability and trust across distributed markets, ensuring every on-chain representation is verifiable through canonical data stored within Vogon’s quantum-secure ledger architecture.

HYBRID DIGITAL ASSET (HDA)

Liquid. Transparent. Intelligent.

The Hybrid Digital Asset (HDA) bridges quantum-grade authenticity with blockchain liquidity. Anchored immutably in the Vogon D²QLDB, each HDA enables verifiable secondary market trading while preserving the canonical integrity of its underlying Quantum Digital Asset (QDA). Through transparent smart contracts and an Authentic Intelligence interface, every HDA can articulate its provenance, ESG impact, and valuation logic in real time. This transforms a coin or token from a speculative unit into an intelligent, auditable asset that merges a trustless blockchain execution with quantum-verifiable oracles truth and intelligent not 'smart' contracts.

THE INFRASTRUCTURE THAT MAKES IT POSSIBLE

Identity-native internet • Sovereign-grade ledger

Web5 provides identity and meaning at the protocol layer. Vogon D²QLDB anchors time, space, industry, and meaning with quantum-resilient integrity.

WEB5

Identity & meaning native

An internet layer where sovereignty, consent, and semantics travel with the user.

VOGON D²QLDB

Canonical asset plane

B58 addressing, validator quorum, dual Merkle validation, STTS anchoring, and MSCI GICS Sub-Industry indexing.

WHY THIS MATTERS

Aligned incentives for everyone

UoW turns identity and productivity into investable signals, building portfolios tied to measurable output rather than speculation.

ROLES IN THE UTILITY OF WORTH

Specialized functions for validation, analysis, and stewardship

The UoW framework requires clearly defined roles that ensure accountability, validation, and forward-looking economic modeling across MSCI GICS structures.

CRWD AMBASSADOR

Community advocate

Represents the Utility of Worth to the public and coalitions, driving adoption and education while ensuring alignment with sovereign identity principles.

VRAI TECHNICIAN

Validation Review & Authentication Inspector

Reviews posts and ledger entries on the D²QLDB, authenticates sources, validates asset integrity, and assigns pedigree rankings.

SECTOR ACTUARY

Macro risk & valuation

Analyzes value flows and risk at the GICS Sector level, producing high-level actuarial forecasts across broad economic domains.

GROUP ACTUARY

Industry group steward

Focuses on GICS Industry Groups, calibrating valuation models and tracing commodity dependencies across related industries.

INDUSTRY ACTUARY

Focused economic analysis

Builds actuarial models for specific GICS Industries, linking digital labor to industry output and commodity inputs.

Sub-Industry ACTUARY

Granular forecasting

Operates at the GICS Sub-Industry level, ranking commodities by causal weight and sensitivity to output, and generating momentum/oscillation forecasts that feed portfolio construction and ICP valuation.

CONCLUSION

Architecture of a new economy

The Utility of Worth is not another approach for financial alpha in the quantum era. It is the architecture of a new economy, where Quantum and Hybrid Digital Assets replace speculation with proof, where value is indexed to commodities and industries, and where it is finally measured as it should be: in human dignity, productive capacity, and sovereign contribution.